This segment is dedicated for understanding two cases of “notification interpretation” & one case of “REPO tracking”. By Bikramaditya Ghosh

Notification:-

RBI/2013-14/181 A. P. (DIR Series) Circular No.24 (August 14th 2014) I Authorized Dealer Banks; Liberalized Remittance Scheme for Resident Individuals- Reduction of limit from USD 200,000 to USD 75,000. Attention of Authorized Dealer Category – I (AD Category – I) banks is invited to the guidelines regarding the Liberalized Remittance Scheme (LRS) for Resident Individuals (the Scheme). On a review of the scheme, it has now been decided to reduce the existing limit of USD 200,000 per financial year to USD 75,000 per financial year (April – March) with immediate effect. Accordingly, AD Category – I banks may now allow remittance up to USD 75,000 per financial year, under the scheme, for any permitted current or capital account transaction or a combination of both. Further, the following changes / clarifications in regard to the remittances under LRS will come into effect immediately: [1]

Effect of the Notification:- [2]

USD/INR close on 13th August – 61.11

USD/INR close on 23rd August- 68.15

% change absolute in 10 Days -11.52% [3]

Reason for such an Effect:-

How to read RBI Circular and translate it in to actual business

LRS cut means, less USD will leave India, which means more USD will stay back in India. Higher availability technically means lesser price. But, USD is a mandatory currency, as it is required for Crude Oil purchase & all other important payments such as ADB loan repayment. So, this action of RBI will be taken as shock, by the market. This will show a push in the panic button by the Central Bank. So, Importers stack USD much more than expected. Thus USD/INR shoots up sky high.

Notification:-

SBI maintained Base rates @9.8% for over two months in late 2013

Effect of the Notification:-

Now in 2013 November SBI hiked [4]their base Rates by 20 BPS to 10%. That means they maintained a clear margin gap from other Banks with 45 BPS (as the others kept the Base Rate in & around 10.25%) for a considerable length of time. If we look at the NPA figure of SBI on Sept 2013 it was 32,151 Cr (Net) which went up to 37,167 Cr (Net) by December 2013. This jump in net NPA is about 0.33% in absolute terms. In real terms it went up to 3.24% from 2.91%. [5]So, it is clearly evident that maintaining lower base rate did not help SBI to cut the NPA, on the contrary it went up quite sharply.

Reason for such an Effect:-

SBI played low o

n the Base Rates, thinking their asset base will grow. Now, when the rates are low, liability base depletes too. So, they maintained the balance. Technically speaking this move is a good move; however the other Banks would have taken loan from SBI to lend it back to the market. This allows the other Banks a straight gain of 20 BPS for that entire period. That gain may not look a substantial gain initially but when lakhs of Crores are in consideration, then it automatically become substantial.

n the Base Rates, thinking their asset base will grow. Now, when the rates are low, liability base depletes too. So, they maintained the balance. Technically speaking this move is a good move; however the other Banks would have taken loan from SBI to lend it back to the market. This allows the other Banks a straight gain of 20 BPS for that entire period. That gain may not look a substantial gain initially but when lakhs of Crores are in consideration, then it automatically become substantial.

REPO Tracking in Indian Context

Let us understand how REPO move is directing the future Interest Rates!!

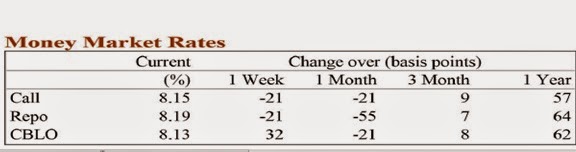

According to 9th May 2014 report REPO (fixed @8% by RBI) is quoting @8.19%. Again if we see the 15th May report (placed at the top, we see clearly that REPO is quoting @ 8.4%. However it is interesting to note from the second graph that last one month REPO is down by 55 BPS. That means may be in a short term REPO is showing bullishness, but on a month to month basis it is bearish by a considerable margin. Let us now have a look at the Inflation scenario in India.

It is quite evident from the above mentioned chart that CPI has been quite volatile in past six months.

Though it has gone down to a low of 8.03% in February 2014, yet it went up sharply to 8.59% in April 2014. But it is still 20 BPS shy of the December 2013 high. On a general basis we can say that CPI is stabilized so far.

Now it is the time to link both. If CPI goes up, then people will suffer as their purchasing power will come down. So, rates should be up also to allow the purchasing power to stay strong. Being consumption led economy, so this is important. [8]Since REPO is trading in discount & CPI is also down, so the chance of REPO hike in September looks quite unlikely as of now.

[2] http://en.calameo.com/books/00297396511171cbe4e96

[3] http://www.xe.com/currencycharts/?from=USD&to=INR&view=1Y

[4] https://www.youtube.com/watch?v=cKcKh9Huna0

[5] http://www.indiainfoline.com/Markets/Company/Fundamentals/Quarterly-Results/State-Bank-of-India/500112

[6]https://www.ccilindia.com/Research/CCILPublications/MarketAnalytics/Lists/lstMarketAnalyticsPubQuaterly/Attachments/324/WMA-09-MAY-14.pdf

[8] http://en.calameo.com/read/0029739658938e5566075