06 Oct,2022.

Mr.X married an individual residing in a leased house with a spouse (housewife) and 1 toddler, who is engaged with a private company since 20 years with one of the reputed organizations. Due to some health concerns, he desired to take a break for a few months and was planning how he can manage for the next 3 months for his and family expenses. During the discontinuity, he recognized that currently I am capable to cope for 3 months of the break with the existing funds and later I can return to any company to continue my career and support his and family expenses. He started thinking about what will happen once I retire? How much expenses did I need to cope with my lifestyle after retirement? Is the savings adequate for my future expenditures? Although he is working for a private company that covers basic health insurance, no defined benefits, and no defined contributions. He understood that Financial management during and in the retirement period involves a lot of convolution and needs a few professional/expert assistances. He decided to start planning for his post-retirement with the help of his friend Mr. Y who is workings as a financial planning consultant. Assessing the need for financial affairs during/in retirement needs a thorough analysis of existing financial position, future objectives, existing expenses, existing benefits, and money management. Mr. Y suggested building a checklist, which helps in proper planning through key variables.

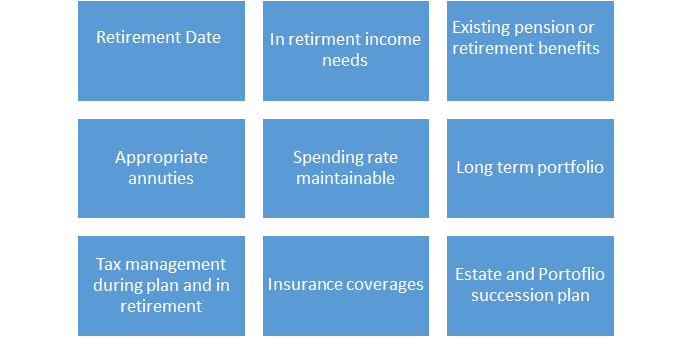

Diagram 1.1 Checklist for Retirement plan

- Retirement date: the utmost significant step to develop a retirement plan is to consider the expected retirement date. It helps in investment, portfolio withdrawal, benefits durability plans, and other retirement plans. Retirement periods are explicit, few individuals may work post-retirement, or few may drop in between.

- In retirement income needs: estimation of the expenditures in retirement by considering the inflation from the date of planning to post-retirement is vital. The common thumb rule states a person’s requisite 80% of employed income in retirement. It may vary from case to case basis, few lower employed income individuals are inclined to consume a higher proportion of employed income in retirement, whereas wealthy retirees might spend fewer than 80% of employed income. There is a likelihood of change in lifestyle which affects their spending habit.

- Existing pension or retirement benefits: how much amount you will receive from existing pension or retirement benefits will assist in the investment planning for long-term retirement expenses. In India, only a few organized sectors, government, and semi-government employees get pension/retirement benefits. Few private entities may provide defined contributions i.e. provident funds which act as a bridge for the retirement income gap. Individuals with no retirement benefits need serious effort to understand their retirement plan, especially the sole earning member. Individuals may opt for PPF- public provident funds for their lump sum requirement at the time of retirement.

- Appropriate annuities: if no or lower income from existing pension/retirement benefits than your retirement expenses – housing, foods, utilities, etc. plan for annuities like NPS- new pension plan or insurance plans with annuities. Evaluate the annuities which suit your needs, where to put and how much to hold. In most cases, the appropriate annuities are needed for an hour for retirement planning.

- Spending rates are maintainable: while assessing the retirement spending rates, it is important to assess the reasonable withdrawal rate based on existing pension/retirement benefits and additional annuity plans by adjusting inflation rates. Spending rates may change due to various environmental factors, retiree consumption patterns, and other personal habits.

- Long-term portfolio: traditional fixed deposit, fixed income like bonds and cash may not assist in anticipated retirement income. It is important to craft a structural portfolio with a combination of stock, cash, bonds, and traditional investment alternatives. Use your own cash flow needs to craft a long-term portfolio and asset allocation positioning. Sometimes it is required to diversify the portfolio from time to time.

- Tax management during and in retirement: while diversifying a retirement investment portfolio, one has to keep in mind tax planning. Many make mistakes of investing in the alternative which provides tax benefits but not providing good returns. In the retirement phase, one has to plan to reduce taxable withdrawal. Early retirement making in portfolio changes will help in making a proper plan, this needs a piece of expert tax advice.

- Insurance coverages: both life and non-life insurance existing and future coverages are required in retirement. Many individuals make mistakes of not availing of personal health and term insurance while at service and claim that the present employers already providing the insurance coverage. Insurance at an early age provides better benefits in terms of premium coverages than covering risk before retirement.

- Estate and portfolio succession plan: retirement planning and estate planning go hand in hand. Documenting your wishes when an individual becomes incapable or die is more valuable at any stage of the life cycle. Retirees or pre-retirees should ask and answer what should happen to your financial assets. What is your spouse or dependents’ health care decision? What instruction do you want to give to yours depends on your behalf? An individual can prepare documentation on their own or take can take legal/expert assistance in a succession plan.

Conclusion:

Retirement planning is crucial for a happy retirement, especially for the individual with no existing benefits. Always follow the retirement checklist starting from assessing retirement date, estimating retirement income needs, quaffing existing pension or retirement benefits, evaluating proper annuities other than existing coverage, assessing whether retirement spending rate is feasible, crafting a long-term portfolio on retirement income needs, proper tax planning, evaluate the existing insurance and pay attention to estate/succession plan. The retirement plan is dynamic and requires more planning and execution. Hence the role of a financial planner/consultant is critical to happy retirement life.