A Case of Time Series Predictive Modelling of Bitcoin Prices

Prof. Kiran Kumar K V

Faculty-Finance & Analytics

International School of Management Excellence (ISME)

88, Chembanahalli, Sarjapura Road, Bangalore-562125

kirankvk@isme.in +91-99644-02318

On one side there was a technological invention of an electronic cash system among peer-to-peer. An alternative currency to be precise. Designed to be used as a medium of exchange in purchase and sale transactions of material goods and services. On the other side, there is a speculative market, constantly looking for underlying assets whose price fluctuates. Bitcoins, supposed to have been a currency, started being measured in dollar terms themselves. That is bitcoins by virtue have become a material, though virtual, that carry a value in dollar count. Now that the bitcoins have a dollar price attached to that, and it was demanded and supplied, by multiple participants, and the fact that the limit to the maximum number of bitcoins that could be explored over time was limited, it became a precious metal, again a virtual one though. A precious metal, which has a price, total available quantity is limited, and the possible legal permission for the bitcoins to be used as common currency in day-to-day transactions – enough reasons for it to become a speculative instrument.

Bitcoins, that were created by Satoshi Nakamoto in 2009 (Nakamoto, 2009) , who chose to remain anonymous till today, were initially proposed to be a virtual currency to be used for quick and safe online payment system, importantly, by avoiding the conventional banking channels. In 2008, bitcoins was announced and a white paper penned under the pseudonym Satoshi Nakamoto was posted to the Cypherpunks mailing list, followed quickly by the source code of the original reference client. Bitcoin’s genesis block was mined around Janu 2009. The first transaction was an online order for a pizza for another using 10000 bitcoins in May 2010 (Bonneau, et al., 2015) . Over a period of time, a special interest was developed among financial market traders in bitcoins, who started trading in bitcoins, and the price of bitcoins started being valued in dollar terms. And as the trading activity, especially, speculative trading began increasing in volumes, and more information started getting formed about the bitcoins, it attracted more traders into the market. Between August-2016 and August-2017, the price of a bitcoin jumped from approximately $570 to $4760 and by December-2017, it reached a level of $13860. By then the total market capitalization of bitcoins globally reached $237.62 billion. It had gained popularity around the globe, and private bitcoin exchanges started to get formed and the trading activity increased by bounds. At the same time, acceptability of bitcoins as a medium of payment in online transactions, has also started gaining acceptance, when vendors like Microsoft started accepting Bitcoins as payment mode.

Bitcoins as a Tradable Security:

Firstly, bitcoins have been used as a tradable security, for almost a decade by now, and there is a price and volume data history available. There is a widespread analyst community involved in the process of understanding the mechanism of bitcoin price discovery constantly working, globally. Study of patterns, study of reactions to news – positive or negative, study of price movements in cycles and the constant exploration of fundamental factors or variables that might possibly be driving the bitcoin prices. Any tradable security in the financial markets, goes through the process of getting itself investigated or branded in terms of its risk-return ratio. The nature of a tradable security is described by the nature of its volatility. In this context, what is the nature of price movement of bitcoins? How predictable is its price, based on its own historical price data? Is it possible to forecast or predict the prices of bitcoins, based on a certain model? Is the bitcoin price fluctuation random or does it follow a pattern? Is the market efficiency theory can be related to bitcoin trading place? At this stage of global position of bitcoin, being selectively accepted as a tradable security, in this analytical paper, we have attempted to answer the above questions.

Literature Review

Literature on Bitcoin Pricing:

Research in the area of bitcoins has started with Satoshi Nakamoto’s white paper on bitcoins. In this paper Nakamoto (Nakamoto, 2009) introduced his/their invention and the mechanism of the new proposed virtual tool for peer-to-peer transaction settlement, without using the conventional currency or the digital signature. The thrust of their paper was that existing online payment systems, required a third party to facilitate settlements, and the trust factor was still the challenge, whereas bitcoins can be employed for the purpose, without relying on trust. Bonneu and others (Bonneau, et al., 2015) have compiled various perspectives on research areas in bitcoin and crypto currency areas. They highlighted the hesitation of researchers in the area of security analysis, in researching on bitcoins, quoting “bitcoins work in practice and in theory”. Clearly putting up the fact that there is no theoretical foundation for bitcoins yet and that makes bitcoins a handicapped topic for research. They also discussed why researchers in security markets also overlook bitcoins as an area of study, as bitcoins’ price stability relies on an unknown combination of socioeconomic factors which is hopelessly intractable to model with sufficient precision. Regarding the price prediction, they quote that they cannot come out with a scientific model with sufficient predictive power to answer questions about how bitcoin might fare with difference parameters, and they pushed for an important role to be played by researchers, instead of “letting the market decide”.

One of the objection against Bitcoins by security analysts is that, unlike other asset classes like, equity or commodity, there is no asset backing behind Bitcoins. Hence, Bitcoins can not be termed as an asset class. This also makes researchers to conclude that the inherent value of the Bitcoin is zero. But, Bitcoin exchange QuietGROWTH (QuietGROWTH, 2018) , in their website, comment that the inherent value of any crypto currency, though each of them is not backed by any tangible asset or a promise by a credible institution, is the trust and belief placed in it by its distributed investors. Their argument is that “even assets that do not generate income, at present or in future, on their own, can be perceived to be valuable. After all, the market-determined pricing, at any point of time, is a function of demand and supply. Whether the current pricing of various crypto currencies is speculative or not, can be just a subjective opinion of someone.”

With this background knowledge and assumptions, can we consider modeling the bitcoin price, such that, it can predict its own pattern, basis its average return and volatility. Similar to predicting the price of a security, most typically, an equity or an equity index, of an inefficient market, whose price does not follow a random walk, can we predict bitcoin prices? The argument of why and how a market can be inefficient, like the information asymmetry, lower number of analysts and participants, lesser regulatory restrictions on trading, lesser risk management mechanisms and so on, are all present in bitcoin markets. The very fact that this becomes an Over-the-Counter market (even though virtual) and not an exchange-driven market, in itself proves that this market is clearly present a case for weak-from inefficient market. Going by that acceptance, can we say that the past prices and volume data can actually help in forecasting the future prices? Can the patterns be established?

If that is so, models that predict the stock price and volatility should be first attempted on bitcoin price data. Modeling the volatility of an equity like security is a complex process.

Bitcoins are traded securities. But, they do not have a set of known variables that can define their price stability. Bitcoin markets are also inefficient, providing a lot of opportunities for those who are able to determine the inherent value. As the markets are inefficient, the first level of available information – historical trade data, that includes the price and volume data, are also not fully subsumed in the price. Chances are very high that the pricing of bitcoins are imperfect and there lies huge potential for abnormal gains.

On the other hand, there are econometric models built to predict the next value of a time series data. These models, do not just consider the pattern or trend or the slope, they also consider the volatility. When the goal of the study is to analyse and forecast volatility, models like ARCH and GARCH have assumed greater importance, especially, time series financial data. (Engle, 2014)

The problem this paper addresses is assuming bitcoin prices follow a pattern or a random walk, can a predictive linear trend model be built using model the volatility of the bitcoin prices?

Objectives

– To forecast the bitcoin price movements using time-series projectors

– To model the bitcoin price and return volatility to build a predictive model

Study and Results

A sample closing prices of bitcoins for 60 months is collected. The summary statistics of the data are provided in Table-1 below:

As can be seen above, bitcoins have had a highly dispersed series of prices as well as monthly returns. The standard deviation of 232213.8 on a mean of 127253 evidences the high volatile nature of bitcoin price movement. The same can be seen in the monthly return series also, with a nearly 80% standard deviation of returns around an arithmetic average return of 17%.

On the same dataset of monthly returns of bitcoins linear trend model is built with the purpose to construct a predictive model in the form: y is the dependent variable – closing price of bitcoin on t, x is the independent variable, in this case the chronologically arranged time t, ais the alpha or the constant of the model, b is the beta or the regression coefficient and

y is the dependent variable – closing price of bitcoin on t, x is the independent variable, in this case the chronologically arranged time t, ais the alpha or the constant of the model, b is the beta or the regression coefficient and  is the random error term. We test for the below hypothesis: Null: H0: b = 0 and

is the random error term. We test for the below hypothesis: Null: H0: b = 0 and

y is the dependent variable – closing price of bitcoin on t, x is the independent variable, in this case the chronologically arranged time t, ais the alpha or the constant of the model, b is the beta or the regression coefficient and

y is the dependent variable – closing price of bitcoin on t, x is the independent variable, in this case the chronologically arranged time t, ais the alpha or the constant of the model, b is the beta or the regression coefficient and

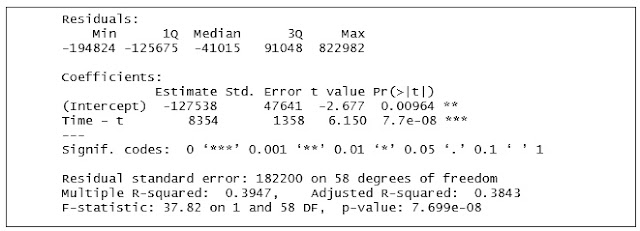

Using analytical package R, a linear trend model is built and the results are given below Table-2:

The results show that the R-squared of this variable is 0.3947, which is less than 0.50 and thus, presents a low explanatory power for the variability in the dependent variable. This may be due to two reasons: that time factor alone cannot be the predictor of the bitcoin prices, which lead us to conclude bitcoin prices are randomly determined, and thus, establishing a prediction model for this may not be correct. This might have been alright conclusion, if we had obtained a not so significant test values. Because, in this case we are obtaining significant values for hypothesis tests, we may resort to the other conclusion that data contain an inherently higher amount of unexplainable variability. In such cases, we can still infer that, despite low R-squared, when combined with low p-values, we can still consider the model to be fit enough to indicate a real relationship between the predictor and response variable, more so when this is a time series modeling exercise.

The ANOVA F-test significance p-value is less than 0.05. We infer based on this that the sample bitcoin data provide sufficient evidence to conclude that the linear trend model fits the data better than the model with no independent variable. This also means that bitcoin prices can be predicted using time progression as an independent variable. This can also be read with the facts that R-Squared is not equal to zero and the correlation between the model and independent variable is statistically significant.

The intercept value is -127538 with less than 0.05 significant value. Therefore, the same can be directly incorporated in the predictive model. The regression coefficient beta of time t on the bitcoin prices is 8354 with a significance value of less than 0.05. Therefore, we reject the null hypothesis that there is no impact of time on the bitcoin price movement and the regression coefficient is not equal to zero.

With the above inputs, we build the time series linear trend predictive model for bitcoin prices as below:

The scope of this article is limited to understand the basic p

roperties of bitcoin price volatility. Further studies using different advanced models can be attempted, like MA, ARMA, ARIMA and models using ARCH, GARCH and BVGARCH.

roperties of bitcoin price volatility. Further studies using different advanced models can be attempted, like MA, ARMA, ARIMA and models using ARCH, GARCH and BVGARCH.

References:

Bitcoin: A Peer-to-peer Electronic Cash System [Online] / auth. Nakamoto Satoshi // Bitcoin. – Bitcoin.org, 2009. – 2018. – https://bitcoin.org/bitcoin.pdf.

Investing aspects pertaining to cryptocurrencies / auth. QuietGROWTH. – 2018.

Research Perspectives and Challenges for Bitcoin and Cryptocurrencies [Book Section] / auth. Bonneau Joseph [et al.] // 2015 IEEE Symposium on Security and Privacy. – San Fransisco, CA, USA : [s.n.], 2015.

Robert Engle [Online] / auth. Engle Robert // NYU Stern. – 2014. – http://www.stern.nyu.edu/rengle/GARCH101.PDF.